Greg Feese | Jul 24 2025 22:19

Four Smart Strategies for Managing Highly Appreciated Stock

Diversification is a pillar of sound investing...

...yet, after the extraordinary short-term returns of a handful of mega cap tech stocks — the Magnificent 7 — many investors now hold too much of one or more individual stocks. From a diversification st andpoint, these are considered highly concentrated positions.

And the higher the concentration, the greater the risk .

Many of our clients who have these positions would love to diversify out of them but avoid doing so due to capital gains taxes incurred upon sale. In this article, we’ll explore strategies your advisor can use to diversify concentrated stock positions — before they go from high-flying to crash-landing.

What if I’m Hesitant to Sell Winners Now?

Letting go of recent winners can be emotionally and financially challenging, particularly when they’ve been instrumental in creating wealth for you and your family. While the purpose of this article is not to convince you to sell, we did want to point out a few sound reasons to diversify.

US stock returns (compared to global stocks) had an abnormally good period the past six years. But looking ahead, that outperformance likely will not persist due to the historically high price of US stocks today.

About two-thirds of stocks underperform the Russell 3000 Index. Historically, the median compound return of individual stocks is surprisingly low — close to zero. In other words, if you ranked the performance of 3,000 stocks over time, the one in the middle (the 1,500th best performer) barely broke even! That’s a sobering reality: even among large pools of companies, many fail to deliver long-term growth.

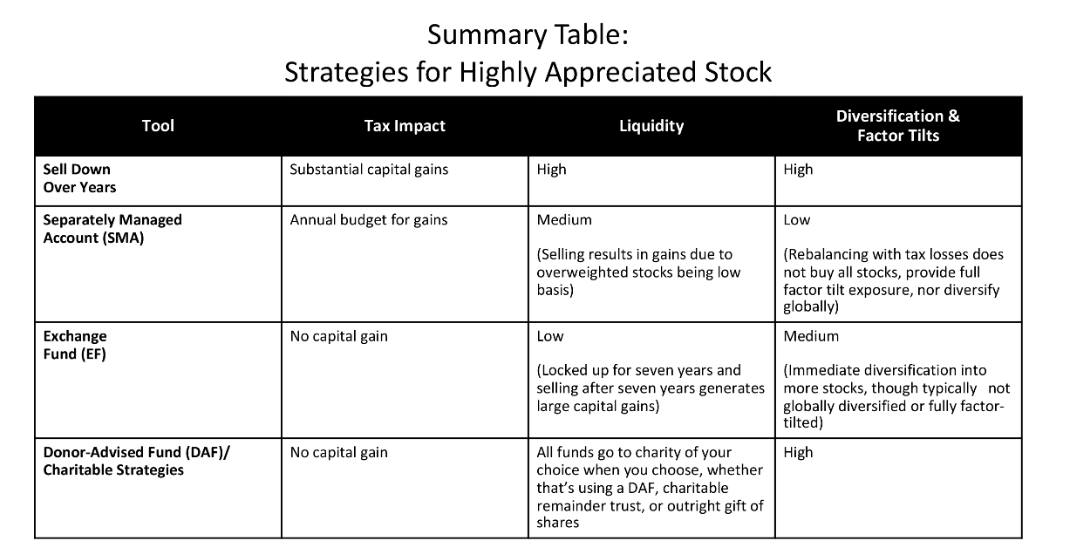

Tools That Let You Diversify

- Sell Down Over Years

One of the most effective strategies is also the simplest. Rather than sell all at once, you can plan to sell over a period of years, such as three to five years, so that if the stock keeps doing well, you won’t experience severe “FOMO” (fear of missing out). The plan might involve selling a third of the position in the first year followed by the same dollar amount each of the next two years. If the stock has done well, you’ll still have a bit left in the third year, and that’s OK. If the stock has done poorly, you will have worked out of the position fully and, thankfully, would have sold a good portion of the stock before the poor performance occurred.

This strategy does generate substantial capital gains each year, but over the next 15 years, your now-diversified portfolio, tilted toward the factors that drive higher expected returns, should deliver a more reliable investment experience to support your retirement and/or future goals.1 For readers who feel that 15 years is a long time, keep in mind that an 80-year-old couple has a greater than 25% chance of at least one of them living to age 95.2 That’s a real possibility and something we should not ignore.

- Tax-Loss Harvesting

During market volatility, sometimes we can strategically generate a capital loss that can be used to harvest an equal amount of gains in your concentrated holdings. And because losses offset gains, doing so lets you strategically rebalance over time, smoothing out the overall tax impact.

If you happen to have a significant number of individual stock positions, holding these in a separately managed account (SMA) can be a vehicle to harvest losses even more tax-efficiently and diversify into a more balanced portfolio.

- Exchange Funds

A newer opportunity for diversifying out of a concentrated, highly appreciated position is something called an exchange fund (EF). (Note that this is not to be confused with an exchange-traded fund (ETF), which is different.)

The basics of how an exchange fund works are:

- You contribute individual stock shares to a pooled partnership.

- There is no immediate sale — so no capital gains tax upon contribution.

- The funds stay locked up for about seven years.

- Some regulatory rules need to be met, such as at least 20% of assets in the exchange fund must be in non-liquid holdings.

- At exit, you receive a diversified basket of positions, not just cash.

- No tax is paid unless you sell.

Historically, exchange funds have only been offered by a few of the big wirehouse firms at very high costs and with only a few dozen securities coming out in the “diversified” portfolio at the end. Dimensional Fund Advisors, our preferred fund provider, is launching a more cost-effective solution later this year that should distribute a more diversified portfolio back to you. More information is to come, so please reach out to your advisor if you have interest in exploring this solution when it becomes available.

- Donor-Advised Funds (DAFs) and Other Charitable Strategies

A classic solution to highly appreciated securities is to give them away to charity. An outright gift of highly appreciated shares can divest a concentrated position without any capital gains tax. Some charitable strategies can even be structured to pay you income, such as a charitable remainder trust.

A donor-advised fund (DAF) is one of the more popular charitable solutions for appreciated stock. When you transfer highly appreciated stock into a DAF, you can sell the stock and diversify without any tax liability. The donation to your DAF allows tax-free diversification of the investment, provides a charitable tax deduction, and gives you discretion to direct grants to individual charities over time. It’s a win for wealth, taxes, and your charitable intent.

Putting It All Together

The Magnificent 7 have averaged about 27% annual returns since 2020 — an exceptional ride.3 But great returns shouldn’t mean you have to suffer disproportionate risk for the rest of your life. By embracing a combination of one or more of these solutions, you can preserve upside while securing long-term stability.

Talk to your advisor about:

- Establishing a sell-down strategy over time

- Harvesting losses, possibly within a separately managed account

- Diversifying through an exchange fund

- Using a charitable strategy such as a donor-advised fund

These strategies, used alone or in combination, offer powerful ways for savvy investors to turn big winners into sustainable, diversified portfolios — without letting taxes hold you hostage.

Sources

1 These “factor-tilts” — overweighting small cap, value, and high profitability stocks, factors that research has shown drive higher expected returns — comprise the foundation of Forum’s evidence-based investment philosophy and portfolio strategy.

2 American Academy of Actuaries and Society of Actuaries, Actuaries Longevity Illustrator, www.longevityillustrator.org/ , Accessed July 7, 2025.

3 Yahoo Finance. Adj. Closing Prices, July 2020–July 2025, Accessed July 8, 2025.

Past performance does not guarantee future results. This article is for informational purposes and not tax or investment advice. Your personal circumstances and tax consequences should be evaluated by both financial and tax professionals before acting on any information herein. Investments involve risk, including loss of principal.

Advisory Services offered through PR Wealth Management Group, Inc., a Registered Investment Advisor. PR Wealth Management Group, Inc., a Registered Investment Adviser, doing business as Legacy Wealth Management Group of Las Vegas, LLC. PR Wealth Management Group, Inc. only transacts business in states where it is properly registered or notice filed, or excluded or exempted from registration requirements. This is not a solicitation for sale of securities in any jurisdiction.. The investment advisory representatives referred to on this site may only transact business, effect transactions in securities, or render personalized investment advice for compensation, in compliance with state registration requirements, or an applicable exemption or exclusion.

© 2025 Legacy Wealth Management Group Las Vegas LLC.