Last week, the U.S. government signed into law the largest economic stimulus bill in our country’s history in response to the effects of the coronavirus. The more than $2 trillion relief package, the Coronavirus Aid, Relief, and Economic Security Act, or CARES Act, is aimed at directly and indirectly alleviating the economic impacts to businesses, families and individuals. The intention of this stimulus is to support those sectors of the economy hardest hit (health care, education, airlines) as well as small businesses and individuals.

There is a lot to unpack! We have attempted to distill the CARES Act into a digestible format, so you can read about what is applicable to your personal situation. We are not covering every detail of the legislation, so this is not an all-inclusive summary.

PART 1: Highly Relevant Federal Stimulus Benefits for Retirees and Business Owners

- Required Minimum Distributions Waived for 2020

- Small Business Forgivable Payroll Loan

PART 2: Programs for Individuals

- $1,200 Recovery Rebate

- Increased Unemployment Benefits for Those Who Become Unemployed or Furloughed

- Penalty-Free Access to Retirement Account Assets

- Federal Student Loan Payments Suspended Through September 30, 2020

- Increase of AGI Limit for Charitable Contributions to 100%

PART 3: Programs for Businesses

- Employee Retention Tax Credit for Employers Who Closed or Lost > 50% of Revenue

- Delay of Payroll Tax Payments (For Those Not Receiving a Forgivable Payroll Loan)

- Net Operating Loss (NOL) Changes

Fasten your seat belts, here we go!

PART 1: Highly Relevant Federal Stimulus Benefits for Retirees and Business Owners

Required Minimum Distributions Waived for 2020

The CARES Act amends legislation to suspend required minimum distributions (RMDs) during 2020.

Our Advice:

- If you are a retiree, and this will result in your 2020 income being substantially lower than normal, please talk to your advisor about doing a strategic Roth conversion.

The suspension applies to traditional IRAs, SEP IRAs, SIMPLE IRAs, 401(k), 403(b) and governmental 457(b) plans for both retirement account owners and inherited IRAs. It includes any 2019 RMDs due by April 1, 2020, as well as their 2020 RMD this calendar year.

Small Business Forgivable Payroll Loan

While technically loans, the portion used directly for payroll and other qualifying expenses may be forgiven. It is a stimulus to encourage small businesses to keep employees employed.

Our Advice:

- All businesses with less than 500 employees should consider applying if they believe the funds are necessary given the uncertain economic conditions caused by the coronavirus.

- Apply now as we expect the funds to deplete as quickly as banking institutions can process the loans, so we would recommend applying early. Most banks are giving their own clients priority, so we urge you to contact your banker or lender as soon as possible.

WHAT? The biggest advantage of the Paycheck Protection Program Loans is the eligibility for the loan to be forgiven on a tax-free basis. The amount of forgiveness will generally equal the amount spent on payroll costs for employees (capped at $100,000 annual salary per employee), mortgage interest, rent and certain utility payments.

HOW TO APPLY? Please contact your bank or SBA lender for more details on this program. To seek forgiveness, the business must submit an application documenting the proceeds went to eligible expenses.

WHO? Eligible businesses, including sole proprietorships, that have fewer than 500 employees (including affiliated businesses) can receive this relief and are required to make a good-faith certification that the loan is needed based on the economic environment caused by the coronavirus.

HOW MUCH? Businesses can generally borrow up to 2.5 times their average monthly payroll costs over the past 12 months. Payroll costs include wages, salary, cash tips, payments for vacation and sick leave, group health benefits, retirement benefits and state taxes assessed on compensation, including payments to independent contractors. Payroll costs do not include employee salaries of above $100,000, salaries of employees who reside outside of the United States, payroll taxes or payments for qualified sick leave or family medical leave for which the business received a credit. The maximum amount that can be borrowed by an eligible business is $10 million, with a maximum interest rate of 4% that can be charged by lenders over a term of up to 10 years.

OTHER DETAILS: The eligible business must have been in operation as of February 15, 2020 and must have had employees for which the business paid salaries and payroll tax. Proceeds from the loan must cover payroll, mortgage interest payments, rent, utilities, and interest payments on other debts incurred prior to February 15, 2020. No collateral is required. The amount forgiven can decrease if there is a reduction in the average number of employees during the eight-week period after the date of the loan, or if the salaries or wages for any employee are reduced by 25% or more during the period. Protections are given to businesses that lay off workers, furlough workers or reduce salary or wages between February 15, 2020 and April 27, 2020, as long as the business rehires workers prior to June 30, 2020 or restores compensation.

Small businesses and private nonprofits affected by the coronavirus can receive an emergency advance grant of up to $10,000 within three days of applying for the Economic Injury Disaster Loan (EIDL). You do have to request the grant after you first apply for EIDL, and these advance grants do not need to be repaid if you are subsequently approved for the EIDL. Businesses that have received an EIDL and/or an advance grant between January 31, 2020 and June 30, 2020 can still apply to receive a Paycheck Protection Program Loan. You cannot cover the same expenses with each loan and any advance amount received would be subtracted from the amount forgiven as your Paycheck Protection Program Loan.

For more information:

U.S. Chamber of Commerce – Coronavirus Emergency Loans Small Business Guide and Checklist

U.S. Senate Committee on Small Business & Entrepreneurship: The Small Business Owner’s Guide to the CARES Act

PART 2: Programs for Individuals

$1,200 Recovery Rebate

The CARES Act provides a payment up to $1,200 for each adult and $500 for each child under 17. The exact amount of payment will be based on information from your 2019 tax return if filed, or from your 2018 return. If you have not filed a return in either year (may not have had enough taxable income to require filing), eligibility will be determined based on your Social Security Benefit Statement (Form SSA-1099) if receiving Social Security payments. Those on other government assistance programs will likely receive their checks through the program.

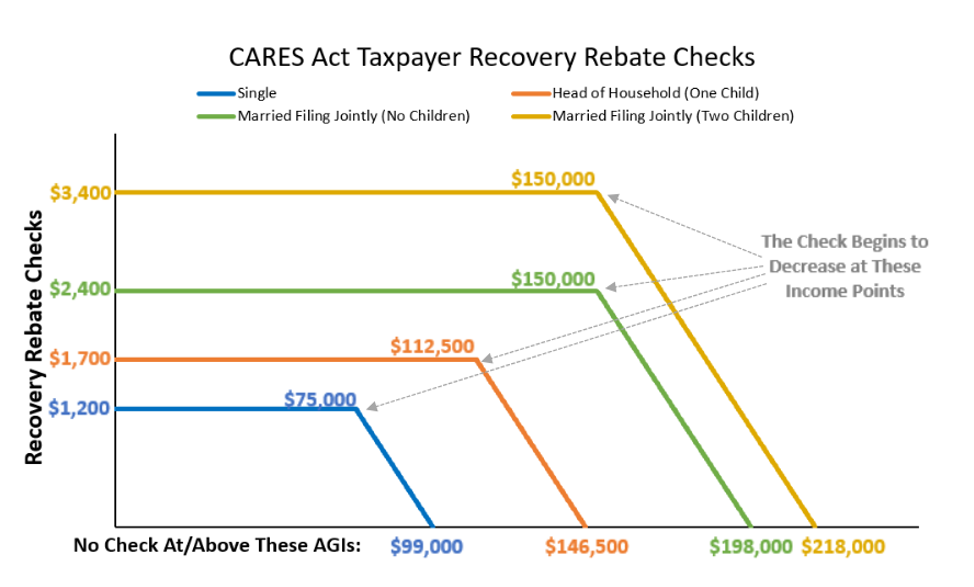

The payments begin to phase out at certain income thresholds. For individuals, the phase-out threshold begins for those earning more than $75,000 annually. For married filing jointly taxpayers, the threshold begins for those earning more than $150,000 annually. For every $100 a taxpayer’s income exceeds the phase-out threshold, the rebate payment is reduced by $5. Payments completely phase out at $99,000 for single individuals or $198,000 for married filing jointly taxpayers with no children. The chart below illustrates the proposed rebate payments and their phase out for multiple taxpayer groups.

Unfortunately, those individuals who were high earners in 2018 or 2019 but have since been laid off, furloughed or saw incomes decrease in 2020 for other reasons may not receive a payment and would not benefit from the rebate until they file their 2020 tax return. If you have yet to file your tax return for 2019 and you earned more income versus 2018, you may be better off receiving a rebate that is calculated based on your 2018 income. The tax filing deadline has been extended by the IRS from April 15, 2020 to July 15, 2020.

Others who are completely phased out of a payment include students who are dependents on a parent’s return or seniors who are claimed as a dependent on an adult child’s return. The payments are not linked to any tax liability you or your household may owe and there is no minimum amount of qualifying income to receive the payment.

Payments could be issued within three weeks. In many cases, payments will be paid electronically via direct deposit with the information provided to the IRS on your 2018 or 2019 tax returns. The payments that will be made to non-direct-deposit refunded tax return individuals or families may be received as paper checks mailed to the filing address. The payments are not considered taxable income, however, it is important to note that the payments act as an advance payment of a credit on your 2020 tax return.

A summary of the direct payments can be found at the link below:

Congressional Research Service: COVID-19 and Direct Payments to Individuals

Increased Unemployment Benefits for Those Who Become Unemployed or Furloughed

Benefits are enhanced for those filing for unemployment. Regular unemployment payments will be increased $600 weekly for four months through July 31, 2020 and eligibility to file for unemployment is extended to those previously ineligible, including part-time employees, freelancers, independent contractors, gig-economy workers and those self-employed. These benefits, which typically run out after six months in most states, will be extended for an additional 13 weeks or for an additional quarter.

Those receiving unemployment income should be reminded to have taxes taken out given this is considered taxable income. The CARES Act also waives the one-week waiting period, so those who file for unemployment may receive benefits available in the first week they are unemployed. You may qualify for unemployment if your wages have been reduced and not totally eliminated.

For more information on how to file for unemployment in your state and to see your state’s unemployment insurance program, see the link below:

CareerOneStop (Sponsored by the U.S. Department of Labor, Employment and Training Administration)

Penalty-Free Access to Retirement Account Assets

The CARES Act both allows penalty-free early distributions and expanded loan amounts.

The CARES Act allows for individuals under the age of 59½ who have been directly affected by the coronavirus to access their retirement accounts, without the usual 10% early withdrawal penalty for up to $100,000 of retirement funds. However, you would still owe income taxes on the amount withdrawn at your ordinary income tax bracket. The distributions can be repaid over three years, and default taxes are spread evenly over 2020, 2021 and 2022.

For those individuals who have been especially affected by the coronavirus, the CARES Act expands the maximum loan amount from $50,000 to $100,000 for employer-sponsored retirement accounts. The CARES Act further amends the vested balance that may be used from 50% to 100% of the balance, up to $100,000. Payments owed on the loan may be delayed for up to one year.

Our Advice:

- Use this as a last resort before taking out personal debt. Other options should be explored first before selling investment assets to fund short-term needs.

Federal Student Loan Payments Suspended Through September 30, 2020

The CARES Act will suspend required payments on federal student loans through September 30, 2020 and no interest will accrue on the loans during this time. It is important to note that voluntary payments are not prohibited and automatic payments will continue unless borrowers take proactive measures to contact their loan provider and pause payments. This suspension of payments does not apply to other programs like FFEL loans, Perkins loans and private student loans.

It is important to note that if working toward qualifying for any of the loan forgiveness programs, payments made over this time will continue to count. Because of this, it may be prudent to pause payments during this window of relief through September 30. The borrower ultimately looking to have their borrowing forgiven would effectively be paying 0% interest debt during this time.

The CARES Act provides relief to student loan borrowers and there are exclusions for employer payments of student loans. If an employer pays student loans on your behalf, it is normally considered taxable income when filing your tax return. The CARES Act will allow your employer to pay up to $5,250 of your student loans on a tax-free basis in 2020. This amount is combined with the regular $5,250 limit employers can pay to provide for current education assistance, thus the $5,250 for 2020 is the maximum tax-free assistance.

Increase of AGI Limit for Charitable Contributions to 100%

Those looking to make qualified cash charitable contributions can completely eliminate their 2020 tax liability. The CARES Act temporarily increases the adjustable gross income (AGI) limit on cash contributions made to charities from 60% of AGI to 100% of AGI for qualified contributions. Any excess contributions above the 100% limit of your 2020 AGI can be carried forward as charitable contributions for up to five years. The CARES Act prohibits contributions from funding donor-advised funds (DAFs) or 509(a)(3) supporting organizations. There is also a new charitable contribution deduction available for those who do not itemize to deduct up to $300 in 2020.

PART 3: Programs for Businesses

Employee Retention Tax Credit for Employers Who Closed or Lost > 50% of Revenue

Employers are eligible if operations were fully or partially suspended due to the coronavirus related shut-down order from an appropriate governmental authority or if gross revenue in 2020 has less than 50% of the revenue from the same quarter in 2019.

Eligibility for the credit will continue until the earlier of:

- December 31, 2020

- The point when government-required suspension of operations ceases and operations can continue

- Gross revenue of the current quarter exceeds 80% of gross revenue from the same quarter in 2019

The credit is equal to 50% of the qualified wages paid to each employee, up to a maximum of $10,000 of wages per employee from March 13, 2020 through December 31, 2020. Qualified wages include wages and health benefits paid to eligible employees. The relief does not apply to employers who receive certain SBA loans under the CARES Act.

For businesses with 100 employees or fewer: All wages are eligible to count toward the credit, whether the business remains open or subject to a suspension order (subject to the reduction in gross revenues).

For businesses with more than 100 employees: Only wages paid to individuals who are not providing services during a government-required suspension of operations or because business revenue has declined are eligible to count toward the credit.

For more information:

IRS FAQs: Employee Retention Credit under the CARES Act

Delay of Payroll Tax Payments (For Those Not Receiving a Forgivable Payroll Loan)

Employers can delay payment of the employer’s share of the 6.2% Social Security (OASDI) portion of payroll taxes related to calendar year 2020 until 2021 and 2022. That means 50% of the payroll taxes that would otherwise be due during 2020 may be deferred until December 31, 2021 and the remaining 50% is due on December 31, 2022.

This relief applies to self-employed individuals as well with respect to the “employer equivalent” portion of their self-employment taxes. The deferral period for payroll begins on March 27, 2020 through December 31, 2020. The relief does not apply to employers who have debt forgiven under the CARES Act for certain SBA loans.

Net Operating Loss (NOL) Changes

The CARES Act amends the Tax Cuts and Jobs Act limits on NOL deductions for corporations (does not include REITs). The amendment allows NOLs incurred in 2018, 2019 and 2020 to be 100% deductible, without the 80% limitation, and losses incurred in the same periods are allowed to be carried back five years to claim refunds of taxes paid in prior years.

For more information for small businesses surrounding the Paycheck Protection Program Loans, Employee Retention Tax Credit, Deferred Payroll Taxes, as well as other helpful provisions, see the link below:

U.S. Senate Committee on Small Business & Entrepreneurship: The Small Business Owner’s Guide to the CARES Act

Sources Used for Reference

Coronavirus Aid, Relief, and Economic Security Act, S.3548, 116th Congress (2020).

“Factbox: What’s in the $2.2 Trillion Senate Coronavirus Rescue Package.” Reuters.com, March 26, 2020.

Larry Katzenstein, Jackie Dimmitt, Steve Gorin and Rick Lawton, “CARES Act Implications for Charitable Giving During COVID-19.” Thompson Coburn LLP, March 31, 2020.

Tony Nitti, “Congress Reaches Agreement on a Coronavirus Relief Package: Tax Aspects of the CARES Act.” Forbes.com, March 25, 2020.

Meet With Your Advisor

It is important to let us know when you have any changes in your investment objectives or financial circumstances. It is also important to review your account beneficiaries each year to make sure that no personal changes need to be made and the primary and contingent beneficiary designations are up to date and accurate. To notify us about any such changes that have occurred since we last met with you, please contact our office and schedule a meeting with your advisor.

We look forward to helping you stay on course.

PR Wealth Management Group, Inc. a Registered Investment Advisor, doing business as Legacy Wealth Management Group of Las Vegas, LLC. PR Wealth Management Group, Inc. only transacts business in states where it is properly registered or notice filed, or excluded or exempted from registration requirements. PR Wealth Management Group, Inc. and Legacy Wealth Management Group of Las Vegas, LLC. are not affiliated companies. The home office is located at 990 Avenue of the Cities, Suite 4., East Moline, IL. 61244. The Las Vegas branch is located at 8235 S. Eastern Ave. Suite 160., Las Vegas, NV. 89123. Before making investment decisions please call our office at 702.545.0680 to receive a copy of PR Wealth’s Advisory Agreement and Form ADV Part 2A, which includes PR Wealth’s fee schedule. This information is intended to serve as a basis for further discussion with your professional advisors. Although great effort has been taken to provide accurate numbers and explanations, this information should not be relied upon for making investment decisions. Web: www.Legacywmglv.com

Forum Financial Management, LP is registered as an investment advisor with the SEC and only transacts business in states where it is properly registered, or is excluded or exempted from registration requirements. SEC registration does not constitute an endorsement of the firm by the Commission nor does it indicate that the advisor has attained a particular level of skill or ability. The home office is located at 1900 S. Highland Ave., Suite 100, Lombard, IL 60148. Before making an investment decision, please contact our office at 630.873.8520 to receive a copy of Forum’s Advisory Agreement and Form ADV Part 2A, which includes Forum’s fee schedule. This information is intended to serve as a basis for further discussion with your professional advisors. Although great effort has been taken to provide accurate numbers and explanations, this information should not be relied upon for making investment decisions. web: www.forumfin.com

Information is used with the express permission from Dimensional Fund Advisors. Dimensional Fund Advisors is an investment advisor registered with the Securities and Exchange Commission. Consider the investment objectives, risks, and charges and expenses of the Dimensional funds carefully before investing. For this and other information about Dimensional funds, please read the prospectus carefully before investing. Dimensional funds are distributed by DFA Securities LLC.

Asset allocation and diversification do not assure or guarantee better performance and cannot eliminate the risk of investment losses. All investment strategies have the potential for profit or loss. Historical performance results for investment indexes and/or categories, generally do not reflect the deduction of transaction and/or custodial charges or the deduction of an investment-management fee, the incurrence of which would have the effect of decreasing historical performance results. There are no assurances that a portfolio will match or outperform any particular benchmark.

Nothing in this publication should be construed as investment advice. All information is believed to be from reliable sources; however, its accuracy and completeness and the opinions based thereon by the author are not guaranteed and no responsibility is assumed for errors and omissions. Any economic and performance data published herein is historical and not indicative of future results. All rights reserved. Please consult your personal advisor and investment prospectus before making an investment decision.

Copyright © 2019 by Forum Financial Management, LP

Legacy Wealth Management Group

Greg Feese CRPC®, Investment Advisor Representative. Advisory Services offered through PR Wealth Management Group, Inc., a Registered Investment Advisor. PR Wealth Management Group, Inc., a Registered Investment Adviser, doing business as Legacy Wealth Management Group of Las Vegas, LLC. PR Wealth Management Group, Inc. only transacts business in states where it is properly registered or notice filed, or excluded or exempted from registration requirements. This is not a solicitation for sale of securities in any jurisdiction.. The investment advisory representatives referred to on this site may only transact business, effect transactions in securities, or render personalized investment advice for compensation, in compliance with state registration requirements, or an applicable exemption or exclusion.

© 2018 Legacy Wealth Management Group Las Vegas LLC.

HELPFUL RESOURCES

Notice and Disclaimer

PLEASE NOTE: The information being provided is strictly as a courtesy. When you access one of these web sites, you are leaving our web site and assume total responsibility and risk for your use of the web sites you are linking to. We make no representation as to the completeness or accuracy of information provided at these websites. Nor is the company liable for any direct or indirect technical or system issues or any consequences arising out of your access to or your use of third-party technologies, web sites, information and programs made available through this website.